Inside Wormhole’s 47-Second Cross-Chain Bridge: What Really Happens When You Move USDC Between Blockchains

A technical deep dive into Wormhole’s architecture, Guardian networks, and why your tokens get destroyed before they arrive.

// TL;DR

Wormhole uses 19 trusted validator companies (Guardians) who watch both blockchains and sign cryptographic proofs (VAAs) confirming cross-chain transfers. It’s fast (47 seconds in my test) but relies on Guardian reputation rather than pure cryptography. The trade-off: Speed and practicality today vs. theoretical trustlessness.

Key insight: Your tokens aren’t “sent” anywhere—they’re destroyed on one chain and released from reserves on another. Nineteen companies with $100M+/year businesses verify this happened.

Table of Contents ▼

// The Transaction That Started This

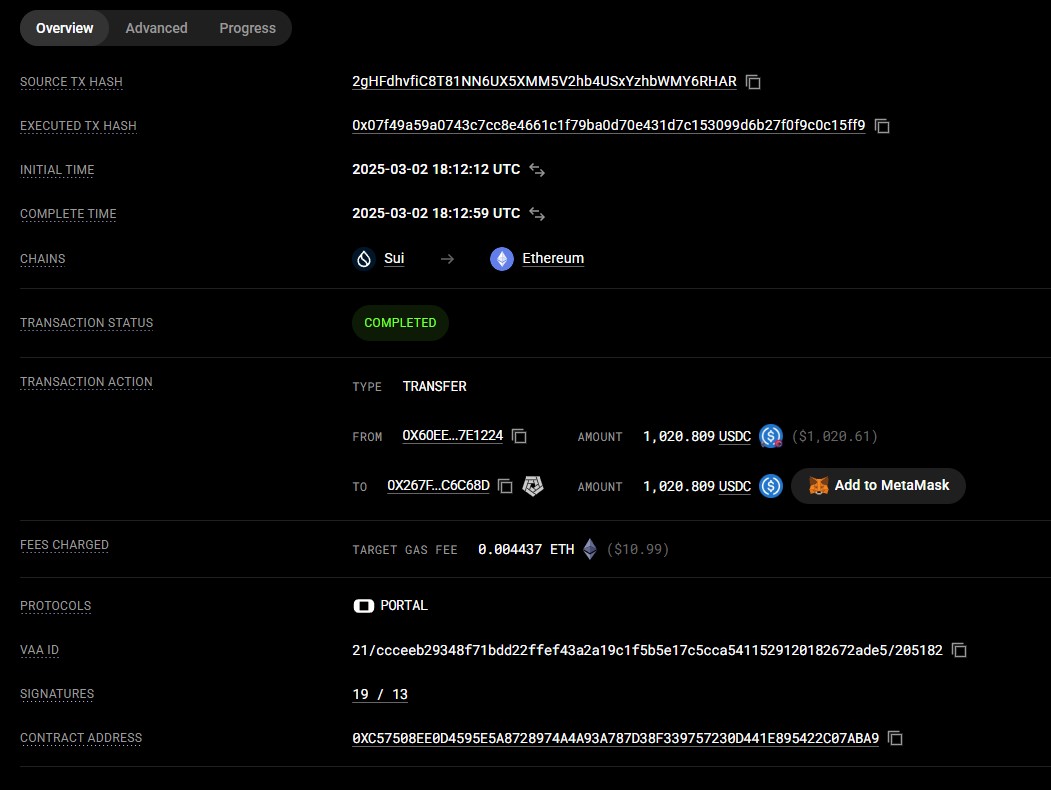

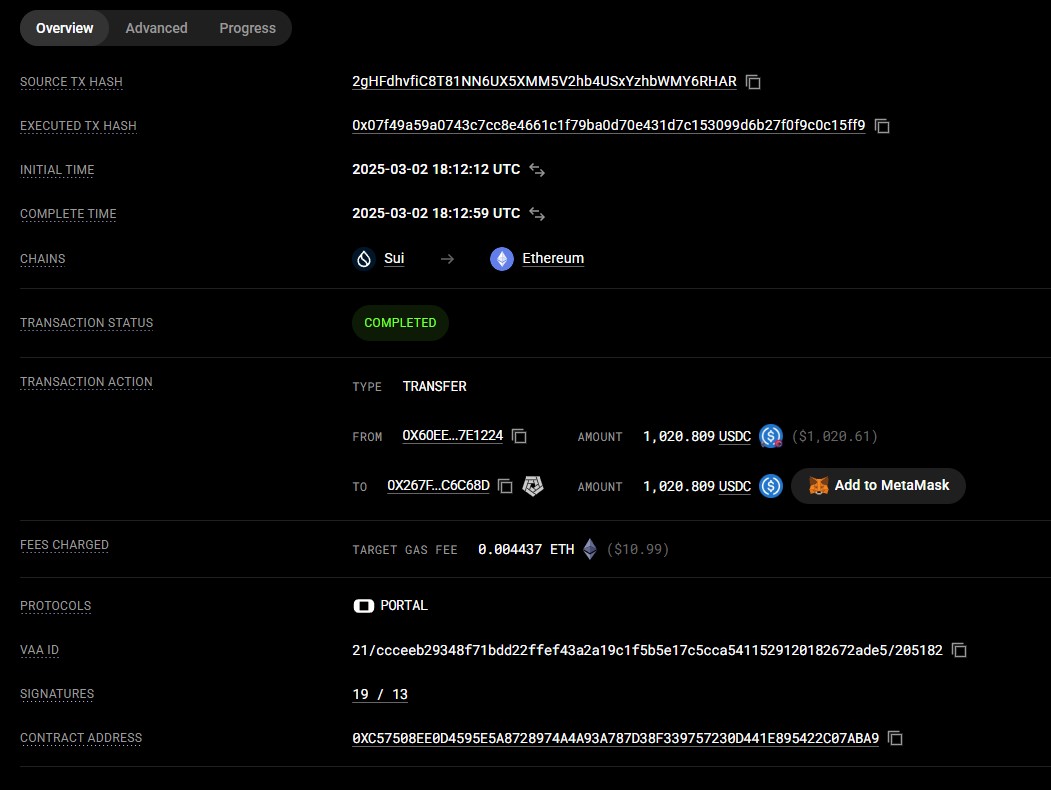

On March 2, 2025, I clicked “Transfer” on Portal Bridge and watched 1,020.809 USDC disappear from my SUI wallet.

Forty-seven seconds later, it appeared on Ethereum.

During those 47 seconds, I had questions:

- Where did my USDC actually go?

- How does Ethereum “know” to give me tokens?

- What are these “Guardians” that were signing something?

- Can I cancel if something goes wrong?

Spoiler: No. My tokens were already destroyed on SUI the moment I clicked confirm.

I’d used bridges dozens of times before—it had become routine. Progress bar fills, tokens appear, move on. But I never understood what was actually happening.

This time, I decided to find out.

What I discovered involved 19 Guardian companies, cryptographic proofs called VAAs, smart contracts on two separate blockchains, and a $150 million reserve pool. The architecture was way more fascinating than I expected.

Here’s what actually happens when you bridge tokens between blockchains.

// What I Saw as a User

The interface was deceptively simple:

- Go to Portal Bridge (portalbridge.com)

- Select SUI → Ethereum

- Enter amount: 1,020.809 USDC

- Click “Transfer”

- Sign in wallet

- Wait

The progress bar showed:

- ✅ Transaction initiated from Sui to Ethereum

- ✅ Transfer 1,020.809 USDC from Sui to Ethereum

- ✅ VAA signed by Wormhole guardians

- ✅ Pending execution in Ethereum

- ✅ Executed in Ethereum

- ✅ Transfer completed

The numbers:

- Time: 47 seconds total (18:12:12 UTC → 18:12:59 UTC)

- SUI fee: ~$0.32

- Ethereum gas: $10.99

- Total cost: $11.31 to move $1,020 across chains

My first thought: That worked surprisingly smoothly. My second thought: But how?

To understand what actually happened, I pulled up my transaction on Wormhole Scan and started digging.

// What Actually Happened (The 5-Step Process)

Here’s a simplified process of what occurred during those 47 seconds:

- SUI → Burns the tokens

- 19 Guardians → Watch & Verify

- 13/19 Guardians → Sign VAA

- Relayer → Submit VAA to Ethereum

- Ethereum → Verify & Release tokens

Let me break down each step.

### Step 1: My USDC Was Destroyed on SUI

This is the part that shocked me.

My tokens weren’t “sent” anywhere. They were **literally destroyed**

Burned, deleted, gone forever from the SUI blockchain.

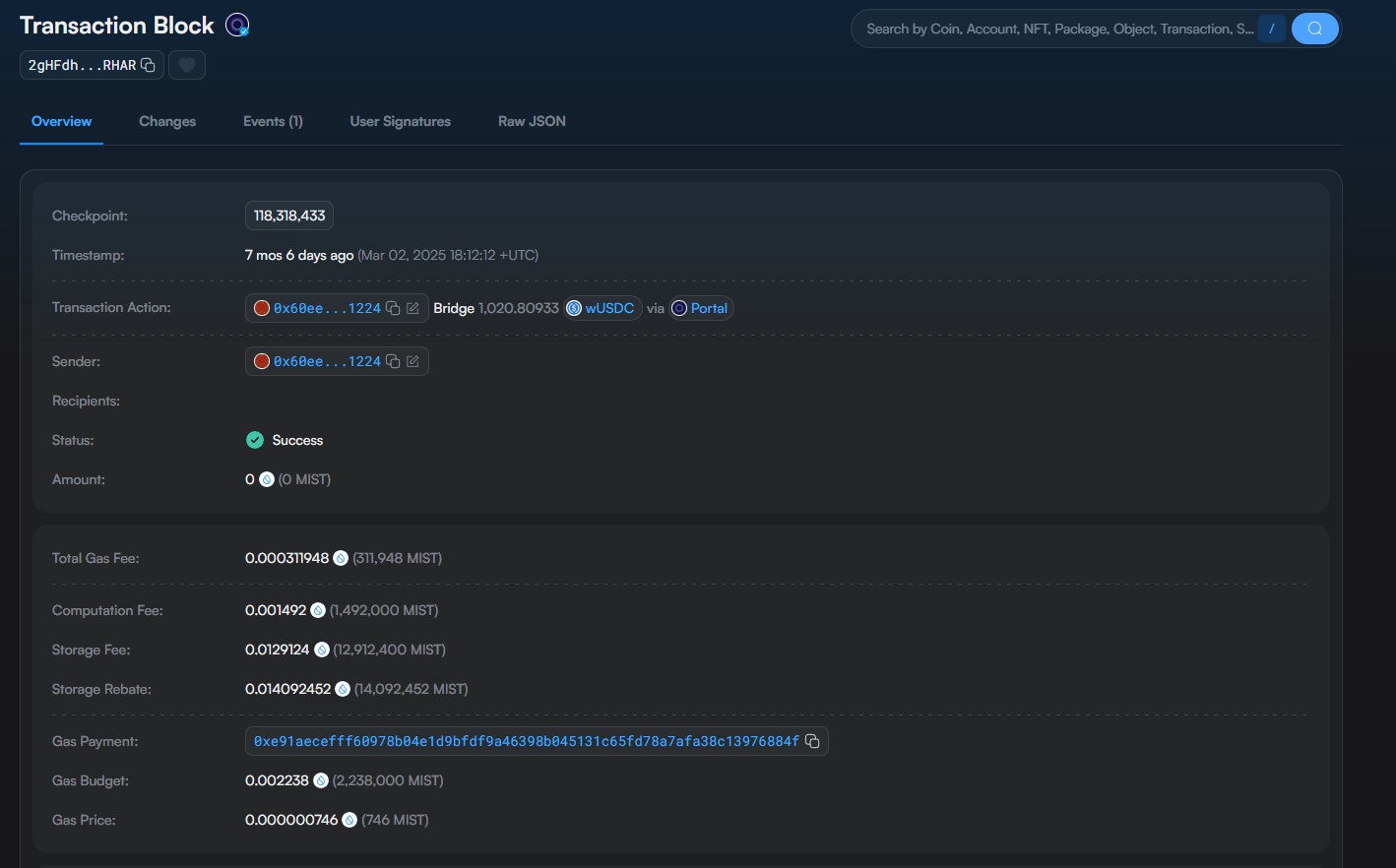

The Wormhole contract on SUI (`0x60ee…1224`) took my 1,020.809 wUSDC (wrapped USDC) and removed it from existence. The blockchain state was updated: my balance went to zero.

In return, the contract emitted an event:

> “User burned 1,020.809 USDC. Send equivalent amount to [my Ethereum address].”

But here’s the critical thing: **At this moment, Ethereum had no idea this happened.**

SUI can’t call Ethereum. Ethereum can’t see SUI. They’re completely separate systems with no communication channel.

This is the fundamental problem cross-chain bridges solve: **blockchains are isolated islands.**

### Step 2: 19 Guardian Companies Witnessed It

Enter the Guardians.

There are 19 companies—major blockchain validators like Jump Crypto, Figment, Certus One, Staked, and P2P Validator—that run something called Guardian nodes.

**Who they are:**

- Jump Crypto (lead Wormhole developers)

- Figment

- Chorus One

- Staked

- P2P Validator

- Certus One

- Everstake

- and 12 other top-tier validators

Each Guardian runs full nodes on **every Wormhole-supported blockchain**. They’re constantly watching for Wormhole bridge events.

When my burn happened on SUI at checkpoint 118,318,433, all 19 of them saw it within seconds.

Each Guardian independently verified:

- Is this from the legitimate Wormhole contract?

- Has the transaction finalized on SUI?

- Is the data correctly formatted?

- Has this event already been processed? (prevent replay attacks)

If everything checked out, they signed it with their private key.

This signature says: **”I, Guardian X, personally witnessed this burn event happen on SUI.”**

### Step 3: 13 Guardians Signed a Cryptographic Proof

The Guardians don’t need all 19 signatures. They only need ** 13 out of 19 ** = a supermajority.

This is based on Byzantine Fault Tolerance, a classic distributed systems concept. You need more than two-thirds majority (13/19 = 68.4%) to be secure against:

- Up to 6 Guardians offline (maintenance, network issues)

- Up to 6 Guardians compromised (hacked)

- Up to 6 Guardians being malicious (trying to steal)

The Guardians broadcast their signatures to each other over a peer-to-peer network. Once 13+ signatures were collected, they assembled something called a Verified Action Approval (VAA), which is a cryptographic proof package.

Think of it like 13 notaries all signing the same document. The VAA contained:

- Source chain: SUI (Chain ID 21)

- Event: “1,020.809 wUSDC burned”

- Target chain: Ethereum (Chain ID 2)

- Recipient: My Ethereum address (0x267F…C68D)

- Timestamp: 2025-03-02 18:12:12 UTC

- 13 Guardian signatures: (cryptographically verified)

- VAA ID: `21/ccceeb29348f71bdd22ffef43a2a19c1f5b5e17c5cca541152912818267…`

This VAA is the “proof” that gets submitted to Ethereum.

### Step 4: The Proof Was Submitted to Ethereum

Someone (usually an automatic bot called a relayer) grabbed the completed VAA and submitted it to Ethereum’s Wormhole contract.

This is the moment Ethereum finally learned about my SUI burn.

The relayer paid the Ethereum gas fee (**$10.99** in my case) to submit this proof on-chain. In my transaction, the relayer was automatically handled by Portal Bridge’s infrastructure.

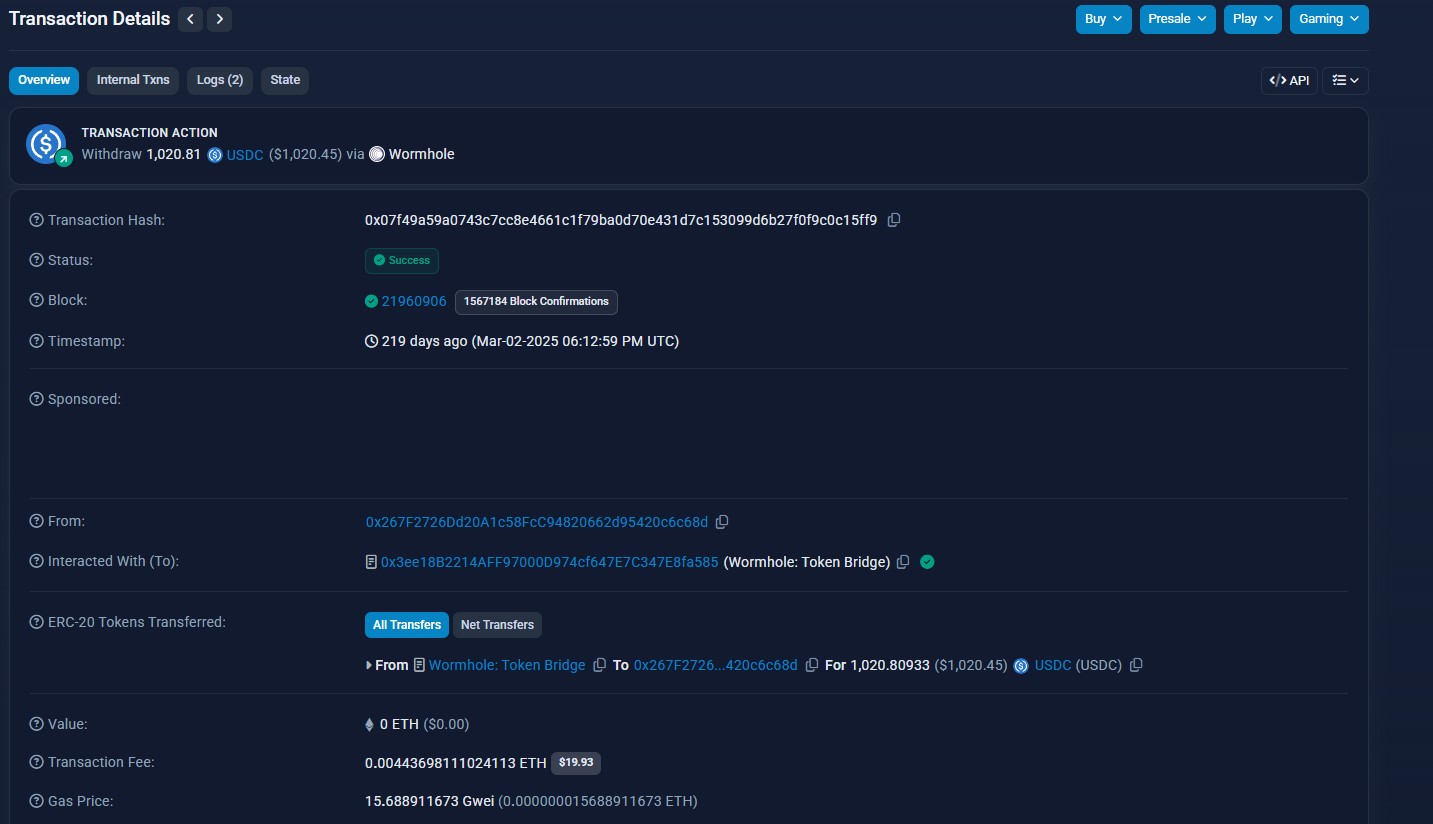

Transaction hash: `0x07…`

### Step 5: Ethereum Verified and Released Funds

Ethereum’s Wormhole contract (`0x3ee18B2214AFF97000D974cf647E7C347E8fa585`) did its job:

Verification steps:

- Verified the 13 Guardian signatures

- Checked the message

- Prevented replay attacks

- Confirmed sufficient reserves

Then it released the tokens:

- Source: Wormhole reserve contract

- Amount: 1,020.809 USDC

- Destination: My Ethereum address

- Status: ✅ **Transfer completed** (18:12:59 UTC)

**Total time: 47 seconds**

// The Key Insight: Blockchains Can’t Talk to Each Other

This is the fundamental problem.

SUI can’t see Ethereum. Ethereum can’t see SUI.

They’re like countries that don’t share a language or communication infrastructure. You need trusted interpreters—the 19 Guardians—who watch both sides and relay messages between them.

When 13 out of 19 Guardians agree something happened on one chain, the other chain trusts their word and acts on it.

It’s not truly “trustless” like a blockchain itself—but it’s pragmatically secure when those interpreters have $100M+/year businesses at stake.

// Understanding Guardians: The Trust Model

When I first saw “19 Guardians,” my reaction was: Who are these people, and why should I trust them?

Why Do Guardians Work for Free?

Here’s what shocked me: Guardians receive $0 in direct compensation from Wormhole.

Zero. Nothing. Nada.

So why would companies like Figment and Jump Crypto run Guardian nodes for free?

Because their reputation is worth $100M+/year.

These companies are already major blockchain validators earning:

- $50M-100M+/year in validator revenue across Ethereum, Solana, Cosmos, etc.

- Billions in customer staked assets under management

- Trust relationships with institutional clients

The economics:

- Cost to run a Guardian node: ~$30K-50K/year in infrastructure

- Risk to validator business: $100M+/year in revenue

- Cost of dishonesty: Lose everything

If Figment lies about a Wormhole transaction, their reputation as a trusted validator is destroyed. They’d lose validator customers across every chain they operate on.

The math makes honesty the only rational choice.

What If a Guardian Tries to Lie?

Let’s say a malicious Guardian tries to sign a fake transaction:

> “1,000,000 USDC burned on SUI” (but it didn’t actually happen)

Here’s what occurs:

- The other 18 Guardians observe the SUI blockchain

- They don’t see any 1M USDC burn event

- They refuse to sign the fake claim

- Only 1 signature collected (need 13)

- Fake VAA is invalid ❌

- Ethereum rejects it automatically

- Other Guardians notice and report the malicious Guardian

- Malicious Guardian gets removed from the Guardian set

- Their reputation is destroyed across the industry

- Their entire validator business collapses

The system is self-policing.

The 13/19 threshold protects against bad actors because you’d need to corrupt 13 separate companies simultaneously—companies that are competitors with reputations worth nine figures.

Extremely difficult. Economically irrational.

// VAAs: The Cryptographic Proof

VAA = Verified Action Approval

Think of it as a notarized, tamper-proof certificate that proves something happened on another blockchain.

My transaction’s VAA was a data packet containing:

- Source chain: SUI (Chain ID 21)

- Event description: “1,020.809 wUSDC burned”

- Destination: Ethereum (Chain ID 2)

- Recipient address: My Ethereum wallet

- Timestamp: March 2, 2025 at 18:12:12 UTC

- 13 cryptographic signatures from Guardians

When Ethereum received this VAA, it could verify mathematically that 13 real Guardians signed it.

Why VAAs Are Secure

- Can’t fake signatures:

- Each Guardian has a private key

- Only they can create their signature

- Ethereum verifies using the Guardian’s public key

- Math makes forgery impossible

- Can’t replay:

- Each VAA is used once

- Ethereum marks it as “processed”

- You can’t submit the same VAA twice to get tokens again

- Can’t modify:

- If you change any data in the VAA, it breaks all the signatures

- You’d need to get 13 Guardians to re-sign the modified version

- Impossible if you’re attacking

It’s elegant. The VAA carries all the information and proof needed to execute the cross-chain transfer, and it’s secured by cryptography and reputation.

// Where the Money Actually Comes From

This was my biggest confusion initially: Where did the USDC on Ethereum come from?

Not from:

- ❌ Circle’s USDC reserves

- ❌ “The Ethereum network”

- ❌ Some magical central pool

But from:

- ✅ Wormhole’s own smart contract on Ethereum

- ✅ Address: 0x3ee18B2214AFF…

- ✅ Currently holds $150M+ in locked USDC

How the Reserve System Works

Wormhole uses a lock-and-mint / burn-and-release model:

When someone bridges Ethereum → SUI:

- Their USDC gets locked in Wormhole’s Ethereum contract

- Wrapped USDC (wUSDC) gets minted on SUI

- Ethereum reserve increases

When I bridge SUI → Ethereum:

- My wUSDC gets burned on SUI (destroyed)

- Ethereum releases USDC from reserves

- Ethereum reserve decreases

The system always maintains 1:1 backing:

Total wUSDC across ALL chains = Total USDC locked on Ethereum

The $150M+ reserve on Ethereum exists because thousands of people before me bridged USDC from Ethereum to other chains. My bridge just reversed that flow.

Why Wrapped Tokens Equal Real Tokens

Here’s what keeps wUSDC trading at $1.00, the same as regular USDC:

- Fundamental backing:

- Every 1 wUSDC is backed by 1 real USDC locked on Ethereum

- This is enforced by smart contracts

- You literally can’t mint more wUSDC than you have USDC locked.

- Redemption guarantee:

- At any time, you can bridge 1 wUSDC back to Ethereum and get 1 USDC

- This sets a floor price.

- If wUSDC traded at $0.90, people would buy it cheap and bridge it back for $1.00 USDC (instant profit)

- Arbitrage forces:

- If wUSDC somehow traded at $1.10 on SUI, arbitrageurs would:

- Bridge USDC from Ethereum

- Sell the wUSDC for profit,

- The price would crash back to $1.00

- Market forces keep them aligned within seconds.

- If wUSDC somehow traded at $1.10 on SUI, arbitrageurs would:

Wormhole didn’t “program” the price to be $1.00. They just created a mechanism that ensures 1:1 backing and redeemability. The market does the rest.

The Trust Chain

When you hold wUSDC, you’re trusting:

- Circle – backs USDC with real USD in bank accounts

- Wormhole – keeps USDC secure in their smart contract

- Guardians – don’t collude to steal the reserves

It’s a double layer of trust. Both Circle and Wormhole need to stay solvent and secure for wUSDC to maintain its value.

This is why wUSDC carries more risk than native USDC. If Wormhole gets hacked (like their $325M exploit in 2022), wUSDC could lose its backing even if Circle is perfectly fine.

// How Wormhole Compares to Other Bridges

After diving into all this, I started thinking about trade-offs. How does Wormhole compare to other bridges?

Wormhole (Proof of Authority):

Architecture ⇒ 19 Guardian validators sign proofs.

- Speed: Fast ✅ (47 seconds for me)

- Security: Trust 19 reputable companies

- Cost: Moderate (~$11 in my case)

- Decentralization: Medium (19 known entities)

Best for ⇒ Speed-critical transfers, moderate amounts ($100-$50K).

—

LayerZero (Oracle + Relayer):

Architecture ⇒ Separate oracle and relayer verify transfers.

- Speed: Similar (30-60 seconds)

- Flexibility: Custom validation options

- Trust: Oracle + Relayer (2 parties minimum)

- Complexity: Harder to audit

Best for ⇒ Developers who want custom security models.

—

Optimistic Bridges (Nomad, Connext):

Architecture ⇒ Optimistic verification with fraud proof windows.

- Speed: Slow ❌ (30-60 minute fraud proof window)

- Security: Anyone can challenge fraudulent transfers

- Cost: Low

- Decentralization: High (permissionless)

Best for ⇒ Large transfers where you can wait.

—

Light Client Bridges (ex. IBC):

Architecture ⇒ Pure cryptographic proofs, no trusted intermediaries.

- Speed: Medium

- Security: Trustless (pure cryptographic proofs)

- Cost: Very high (expensive to verify on-chain)

- Decentralization: Maximum

Best for ⇒ Maximum security, regardless of cost.

—

Wormhole made a bet: ship a fast, pragmatic solution now that leverages existing validator reputation, then plan a migration to zero-knowledge proofs later when the technology matures.

It’s not trustless today, but it’s fast and secure enough for billions in volume. And there’s a clear path to becoming trustless in the future through ZKPs.

Get users today. Add mathematical trustlessness tomorrow.

The Trade-Offs

You can optimize for 2 out of 3: Fast, Cheap, or Trustless.

- Wormhole: Fast + Cheap (sacrificed trustlessness)

- Optimistic bridges: Cheap + Trustless (sacrificed speed)

- Light clients: Fast + Trustless (sacrificed cost)

Wormhole’s bet: Get users today with pragmatic trust model, migrate to zero-knowledge proofs when the technology matures.

Ship now. Perfect later.

// What This Means for Users

When to Use Wormhole:

- You need speed (under 1 minute)

- You’re bridging moderate amounts ($100-$50K)

- You trust major validator companies

- You’re bridging between popular chains (Ethereum, Solana, SUI, Polygon, etc.)

When to Avoid Wormhole:

- You’re bridging huge amounts ($1M+) → Split into smaller transactions or use multiple bridges

- You need absolute trustlessness → Use IBC or optimistic bridges

- You’re bridging to/from obscure chains → May not be supported

Risk Assessment:

Smart contract risk: Moderate

- Audited by multiple firms

- But history of $325M hack in 2022 (Guardian key compromise)

- Team refunded users and upgraded security

Guardian collusion risk: Low

- Would need 13/19 validators to collude

- Each has $100M+/year business at stake

- Economically irrational

Wrapped token risk: Moderate

- Depends on reserve backing staying intact

- If Wormhole fails, wUSDC could lose peg

- Always check reserve backing before holding large amounts

My take: For most retail users moving $100-$10K, Wormhole is pragmatically secure. The Guardian model works in practice. The speed is worth the slight trust trade-off.

For whales moving millions, I’d split into multiple transactions across multiple bridges.

// What I Learned

1. Blockchains Don’t Communicate

They’re like countries that don’t share a language. You need trusted interpreters (Guardians) to relay messages between them. It’s not truly “trustless,” but it’s pragmatically secure when those interpreters have $100M+/year businesses at stake.

2. Reputation Is the Real Currency

Guardians work for $0 direct compensation because reputation is worth vastly more. The economic incentives align toward honesty. Game theory makes attacks irrational.

This was a fascinating realization: sometimes social and economic pressure can be just as effective as cryptographic guarantees; especially when the economic pressure is nine figures.

3. Wrapped Tokens Are IOUs Backed by Collateral

wUSDC isn’t magic internet money. It’s an IOU backed by real USDC locked in a smart contract. The market keeps it priced 1:1 through arbitrage and redeemability. If the backing fails (bridge hack), the price crashes.

Always understand what’s backing your wrapped tokens.

4. Architecture Is Evolving

Wormhole’s current Proof of Authority model is a stepping stone. The long-term vision is zero-knowledge proofs. Mathematical verification instead of trust. They’re being pragmatic: ship what works now, upgrade to trustless later.

I respect that approach more than waiting years for perfect technology that never ships.

// Final Thoughts

Forty-seven seconds. That’s how long it took to bridge $1,020 across two completely separate blockchains that can’t talk to each other.

The fact that it works at all—smoothly, reliably, handling billions of dollars per month—is genuinely impressive.

Not because of clever algorithms or fancy cryptography, but because of aligned incentives and reputation economics.

Nineteen validator companies, each with $100M+/year businesses on the line, watching blockchains and signing proofs. Game theory making honesty the only rational choice.

It’s not mathematically perfect. It’s not technically trustless.

But it’s pragmatically secure, fast enough for real users, and handling real volume today.

That’s the bridge builder’s dilemma: ship a working product now that gets adoption, or wait years for the theoretically perfect solution that might never get used.

Wormhole chose to ship.

And for a first-generation cross-chain protocol, they made the right call.

Next up: I’m diving into LayerZero’s architecture to see how their oracle + relayer model compares. How does separating verification into two parties change the security model? Stay tuned.

Alex G.

Cross-Chain Infrastructure Developer | Bridge Security Researcher

Building tools and insights for the multi-chain world at Web3Fuel.io. Focused on cross-chain bridge security, protocol analysis, and developing practical utilities that help users navigate multi-chain infrastructure safely and efficiently.

From development to cross-chain expertise, documenting the journey of building better infrastructure for the decentralized web.